3 Reasons Rivian Stock Is a Buy Now

[ad_1]

Just about every investor would be thrilled to discover the next Tesla (TSLA 4.51%), and the truth is they may not find a stock that rockets quite like the well-known electric vehicle maker. However, investors can still benefit from an excellent young competitor to ride the wave as mass adoption of electric vehicles (EVs) takes place. Here are three reasons why Rivian Automotive (RIVN 4.56%) might be the best option right now.

Production is ramping up

Perhaps the first box investors need to check off when considering investing in young EV makers is production. Many young EV companies can steer clear of scrutiny on debt, cash on hand, and capital expenditures, but rarely will investors accept disappointing production acceleration.

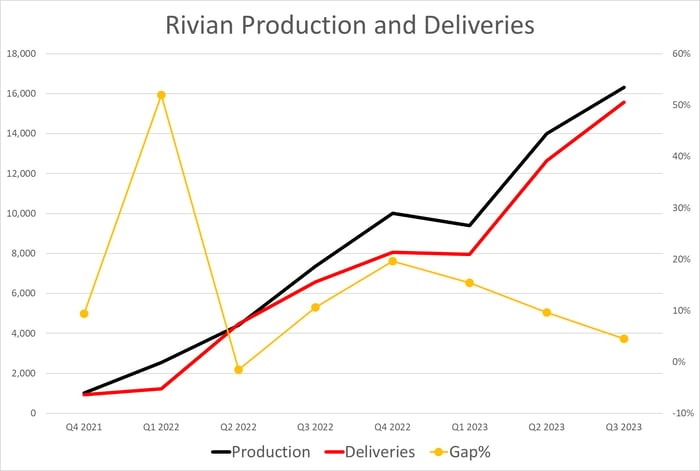

Rivian quickly found that disappointing investors with slowing production went over poorly when it hit a speed bump toward the end of 2022. However, management adjusted its assembly line to incorporate its in-house motor and drastically reduced the production bottleneck. The result has been excellent over the past three quarters with production and deliveries sharply increasing, and the gap in between those two variables narrowing.

Data source: Rivian production press releases. Chart by author.

The bottleneck relief has made such an impact that management raised its full-year production guidance, for the second quarter in a row, up to 54,000 vehicles. To put it bluntly: Rivian’s production is moving in the right direction, and quickly.

Efficiency is improving

One could argue that increasing production isn’t all that helpful if you’re losing more money for each vehicle rolling off the assembly line. The good news for Rivian investors is that the EV maker simplified its product portfolio, stabilized its supply chain, and improved spend efficiency across labor, overhead, logistics, and inventory, among other variables.

The result of those cost efficiency measures was a roughly $2,000 improvement in gross profit per unit (GPU) during the third quarter, compared to the second quarter. Better yet, management expects to see more benefits going forward thanks to supplier price reductions, new technologies, and a reduction in commodity costs.

Delivery vehicle orders could expand

Rivian’s partnership with Amazon will be one investors need to keep an eye on. Originally the deal between the two companies was for Rivian to produce roughly 100,000 electric delivery vehicles for Amazon only, designed to save the latter millions of metric tons of carbon annually.

However, after recent negotiations, Rivian announced during the third quarter that the commercial van deal is no longer exclusive to Amazon, opening up the doors for a plethora of other companies to purchase large numbers of electric commercial vans.

Currently, this appears to be the best of both worlds for Rivian. It maintains a strong connection with Amazon and can also boost its sales with additional sales — potentially large bulk sales — to other commercial delivery companies. If the fading exclusivity between Amazon and Rivian ends up deteriorating their partnership (remember that Amazon owns roughly 17% of Rivian shares), it could end up weighing on Rivian’s share price.

The bottom line

Rivian’s recent results emphasize the progress it’s made with key value drivers including production, deliveries, and cost efficiency. In fact, its third-quarter annualized production rate topped 65,000 units, which should only increase in the quarters ahead.

The young EV maker is focused on further improving those factors mentioned above, while also improving the customer experience of owning a Rivian vehicle, and is opening additional demo drive locations where current and potential customers can experience the vehicles.

Rivian is making the right moves to produce and deliver more vehicles more profitably, while also opening the doors to boost sales through multiple avenues. These are just three of the reasons that make Rivian a very intriguing investment opportunity in the rapidly evolving EV industry.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Daniel Miller has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Tesla. The Motley Fool has a disclosure policy.

[ad_2]