This Magnificent 7.4%-Yielding Dividend Stock Will Give Investors Yet Another Raise in 2024

[ad_1]

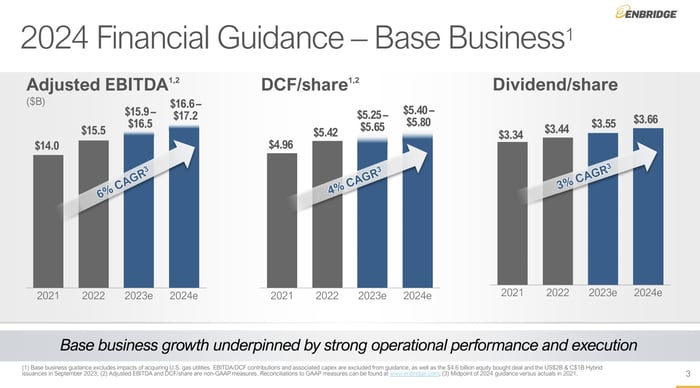

Enbridge (ENB 1.04%) recently revealed its financial expectations for 2024. The Canadian pipeline and utility giant expects to deliver low-single-digit earnings and cash-flow growth next year without factoring in the positive impact of its three pending gas utility acquisitions from Dominion Energy. That’s giving it the confidence (and the fuel) to increase its 7.4%-yielding dividend again next year.

Here’s a look at what the pipeline company sees ahead in 2024 and beyond.

The steady growth continues

Enbridge expects to continue growing next year:

Image source: Enbridge.

The company anticipates its adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) will rise by about 4% in 2024 at the midpoint of its guidance ranges. Meanwhile, it sees its distributable cash flow (DCF) per share increasing by about 3% at the midpoint. That’s giving it the power to increase its dividend by 3.1%. Next year will be Enbridge’s 29th straight year of increasing its dividend, one of the longest streaks in the energy sector.

Enbridge expects growth from all four of its business units next year:

- Liquids pipelines: Strong system utilization will more than offset lower tolls on its Mainline system.

- Gas transmission and midstream: The acquisitions of Morrow Renewables, Aitken Creek, and Tres Palacios will supply incremental earnings. It will also benefit from a partial-year contribution by its Venice extension, lower operating and administration costs, and higher rates on recently signed contracts.

- Gas distribution and storage: Customer additions and higher rates will boost earnings at its gas utilities.

- Renewable power: Acquiring additional interests in Hohe See and Albatros will supply incremental income. It will also benefit from the expected completion of the Fecamp and Provence Grand Large offshore wind farms.

The company will see balanced growth next year. It’s benefiting from improved earnings across its legacy operations, 3 billion Canadian dollars ($2.2 billion) of tuck-in acquisitions completed in 2023, the CA$3 billion ($2.2 billion) of organic expansion projects it completed this year, and partial contributions from the CA$4 billion ($2.9 billion) in projects it expects to complete next year.

Enbridge’s guidance doesn’t include any impact from its $14 billion gas utility acquisitions from Dominion, which it expects will close next year. It will see partial contributions from that transaction next year, which could drive its adjusted EBITDA above the upper end of its guidance range. However, the deals won’t be accretive to its DCF per share until 2025.

More growth is coming down the pipeline

The Dominion deals will provide Enbridge with lots of momentum heading into 2025 when it will get a full-year adjusted EBITDA and DCF contribution from those businesses. Meanwhile, the deals will help power incremental earnings growth beyond 2025 as Enbridge benefits from the $3.7 billion of capital it expects to invest in expanding those utilities through 2027.

Those gas utility expansion projects are part of the CA$17 billion ($12.5 billion) of commercially secured capital projects Enbridge has lined up that should enter service in 2025 and beyond. Other notable projects include:

- Three large-scale natural gas pipeline projects (Aspen Point, Sunrise, and Rio Bravo).

- Woodfibre LNG.

- Another European offshore wind farm (Calvados).

These and other secured capital projects will come online through 2028.

These projects support Enbridge’s view that its adjusted EBITDA and DCF per share will grow at around a 5% annual rate over the medium term. That should enable Enbridge to continue increasing its dividend, likely at a low-to-mid single-digit annual rate.

More dividend growth ahead

Enbridge has been a consistent grower over the years. That should continue in 2024, with the company expecting its earnings, cash flow, and dividend to all rise at a low-single-digit rate. Meanwhile, it has plenty of fuel to continue growing at or above that rate in the future. Add that earnings growth to its 7.4%-yielding payout, and Enbridge has the fuel to produce double-digit total returns in the coming years. That’s a great return from one of the lowest-risk business models in the energy sector. It makes Enbridge a great income stock to buy and hold for the long term.

Matthew DiLallo has positions in Enbridge. The Motley Fool has positions in and recommends Enbridge. The Motley Fool recommends Dominion Energy. The Motley Fool has a disclosure policy.

[ad_2]