Got $1,000? Buy This Ultra-High-Yield Dividend Stock for Income and Upside

[ad_1]

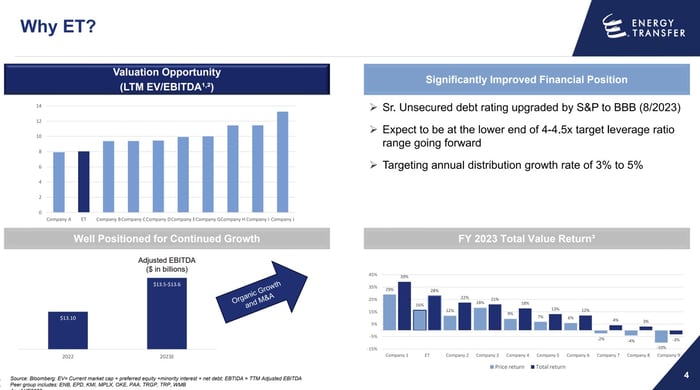

Energy Transfer (ET 2.32%) offers investors the best of both worlds. The master limited partnership (MLP) has a massive yield (currently around 8.5%). Because of that, it can provide investors with a lot of income. The main reason it has such a high yield is it trades at a bottom-of-the-barrel valuation. That gives it significant appreciation potential.

Those features make it a great opportunity for those with $1,000 or less to invest. It has the potential to produce a high-octane total return.

An attractive and growing income stream

Energy Transfer generates a lot of steady cash flow as stable, fee-based structures supply about 90% of its earnings. The midstream company produced about $7.6 billion of distributable cash flow last year. It distributed about $4 billion to investors, enabling it to retain $3.6 billion of its cash flow. That gives this MLP a massive cushion, helping put its big-time payout on an extremely firm foundation.

The MLP used its retained cash to fund expansion projects (about $1.6 billion last year) and strengthen its balance sheet. That gave it the flexibility to make two acquisitions last year. Even after completing those deals, the company expects its leverage ratio to be in the lower half of its 4.0 to 4.5 times target range this year. That feature puts its high-yielding distribution on an even firmer foundation.

Energy Transfer’s stable cash flow, low payout ratio, and strong balance sheet mean investors can bank on its 8.5% yielding distribution. The MLP would turn a $1,000 investment into about $85 of annual passive income at that rate. That’s a nice base return, especially when the dividend yield of the S&P 500 is less than 1.5% (meaning an investor would generate less than $15 of annual income if they invested the same amount in an S&P 500 index fund).

The company’s current yield is only the starting point. Energy Transfer expects to increase its distribution by about 3% to 5% annually by raising its payment slightly each quarter. That will supply investors with a steadily growing income stream.

Dirt cheap with upside catalysts

The main reason Energy Transfer has such a high yield is its dirt-cheap valuation:

Image source: Energy Transfer.

As the chart in the upper left-hand side of that slide shows, it has one of the cheapest valuations in its peer group. That drives the view that Energy Transfer has meaningful upside. The average 12-month price target of analysts who follow the company is $18.13 per unit (more than 20% above the current price), while the high is $22 per unit (roughly 50% above the current price).

Energy Transfer has lots of ways to narrow that valuation gap. One potential option is to use some of its growing excess free cash flow to repurchase some of its units. The MLP’s long-term capital-allocation strategy would see it pay about 53% of its cash in distributions each year (roughly $4 billion), reinvest 27% to 40% on expansion projects ($2 billion to $3 billion), and use the remaining 7% to 20% on debt reduction and unit repurchases ($500 million to $1.5 billion). With its capital spending expected to be $2.4 billion to $2.6 billion this year and its leverage ratio trending toward the lower half of its target range, it should have the flexibility to launch a unit-repurchase program in 2024.

Another potential upside catalyst is finally approving its long-delayed Lake Charles LNG project. It’s working to secure final approvals and the partners needed to move forward with the project.

Finally, the company is ready to continue consolidating the midstream sector. It made two acquisitions last year, which, along with expansion projects, should fuel 7% earnings growth in 2024. Its most recent acquisition (a $7.1 billion merger with Crestwood) is progressing better than expected. Energy Transfer anticipates capturing $80 million of merger synergies, double its initial expectation. It also sees the potential for future commercial synergies. Another needle-moving deal like that could help further boost its earnings and, eventually, its valuation.

High-octane total return potential

Energy Transfer’s high-yielding distribution can supply investors with an attractive and growing income stream. Meanwhile, the MLP has lots of upside potential due to its low valuation. It has several catalysts on the horizon that could help narrow the gap. Those factors could give the MLP the fuel to produce robust total returns. That makes it a great place to invest $1,000 right now to earn a strong and steadily rising income stream with meaningful price-appreciation potential.

Matt DiLallo has positions in Energy Transfer. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

[ad_2]