I Just Opened an Investment Account for My Newborn. Here Was My First Purchase

[ad_1]

The most important investment decision you’ll ever make is to start investing. Time is your best friend in investing, and if you start an account when your loved one (or friend) is young, you’ll set them up for the best possible outcome.

I recently did the same for my newborn, hoping to set her up for college, retirement, or other expenses she’ll incur early on in adulthood. Some may think determining my first investment for her would be difficult, but it was a no-brainer for me.

The Nasdaq-100 lists some of the best companies

My first purchase for my daughter was the Invesco QQQ Trust (QQQ 0.43%). This ETF tracks the Nasdaq-100, which comprises some of the most innovative companies in today’s society. Take a look at the top 10 holdings in the fund and tell me that these companies won’t continue changing the world over the next couple of decades.

| Company | Allocation |

|---|---|

| Apple (NASDAQ: AAPL) | 11.3% |

| Microsoft (NASDAQ: MSFT) | 10.4% |

| Amazon (NASDAQ: AMZN) | 5.7% |

| Nvidia (NASDAQ: NVDA) | 4.3% |

| Meta Platforms (NASDAQ: META) | 3.7% |

| Broadcom (NASDAQ: AVGO) | 3% |

| Alphabet Class A (NASDAQ: GOOGL) | 2.9% |

| Alphabet Class C (NASDAQ: GOOG) | 2.9% |

| Tesla (NASDAQ: TSLA) | 2.8% |

| Adobe (NASDAQ: ADBE) |

2.2% |

Data source: Invesco. Makeup as of Dec. 6, 2023.

This group is a solid pick, and the other constituents of the Nasdaq-100 are also strong candidates to help this investment move forward. Within this group are exciting trends, like cloud computing, generative AI, electric vehicles, and more.

But why did I choose the QQQ over other investment options, like an S&P 500 index fund or a total market fund? The truth is, I didn’t. The investment account also contains the Vanguard S&P 500 (NYSEMKT: VOO) and Vanguard Total Stock Market (NYSEMKT: VTI) ETFs, which are added for balance.

The Nasdaq-100 notoriously became inflated during the dot-com burst in the early 2000s, and I’d like to balance out the account with more conservative picks because another tech bubble will likely occur at some point. Even with that threat, I still think the QQQ is the best pick of the three.

The QQQ’s performance has been stellar

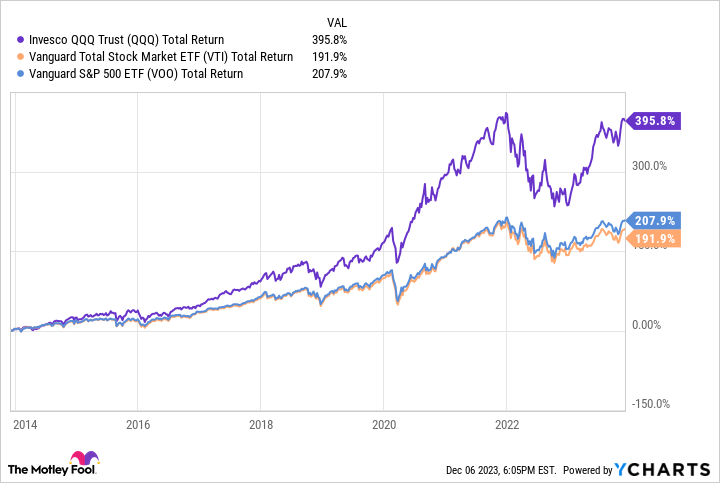

Over the past decade, the QQQ has trounced the other two funds.

QQQ Total Return Level data by YCharts.

The dominance also stretches back even further. If I had taken the same investing approach 18 years ago (to simulate what would have happened if someone did what I’m doing) with $1,000, this would be the result.

QQQ Total Return Level data by YCharts. Note: The VOO fund was created in 2010, so another S&P 500 index fund was used.

Ending up with nearly double your money at the end of the run is incredible, and that is why I’m choosing to invest in the QQQ at a higher concentration over the others. So, why don’t I go all-in on the QQQ versus the others if I’m confident in its outperformance?

Well, tech is rather hot right now, and it has led to some inflated valuations. While it’s not near the levels seen during the tech bubble, they are high. I want to keep the account fairly balanced, so having both options is smart, especially because the S&P 500 doesn’t have the same tech concentration as the QQQ.

There’s nothing wrong with the other indexes, but grabbing a share or two of the QQQ is a surefire way to set your kids up for long-term investment success. And it’s also a fantastic way to invest for retirement.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Adobe, Alphabet, Amazon, Invesco Qqq Trust, Series 1, Tesla, Vanguard Index Funds-Vanguard Total Stock Market ETF, and Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Adobe, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Tesla, Vanguard Index Funds-Vanguard Total Stock Market ETF, and Vanguard S&P 500 ETF. The Motley Fool recommends Broadcom and recommends the following options: long January 2024 $420 calls on Adobe and short January 2024 $430 calls on Adobe. The Motley Fool has a disclosure policy.

[ad_2]