Start the Year Off Right With This Surefire Warren Buffett Index Fund That Could Turn $200 Per Month into $76,000

[ad_1]

Warren Buffett is known for his ability to pick a great stock — and win through that investment over time. As chairman of Berkshire Hathaway, he’s helped deliver a compounded annual gain of nearly 20% over 57 years, surpassing the S&P 500‘s (SNPINDEX: ^GSPC) compounded increase of about 10%. So, if you want to follow in the billionaire investor’s footsteps, you may think the only option is to perfect your stock-picking skills.

But you actually have another much easier option that’s Buffett-endorsed. The Oracle of Omaha even follows this bit of advice himself. I’m talking about investing in funds that track the S&P 500 Index. Berkshire Hathaway owns two of them, the SPDR S&P 500 ETF Trust (SPY 0.07%) and the Vanguard S&P 500 ETF (VOO 0.05%). A regular investment in one of these funds over time could significantly build your wealth, according to Buffett. Let’s take a closer look at this top investor’s advice and how to apply it.

Buffett’s words of advice

Though Buffett has generated most of his wealth through selecting individual stocks, he’s acknowledged this is often challenging. And in the 2013 Berkshire Hathaway letter to shareholders, Buffett suggested a way around this problem.

He wrote: “The goal of the non-professional should not be to pick winners…but should rather be to own a cross-section of businesses that in aggregate are bound to do well. A low-cost S&P 500 index fund will achieve this goal.”

S&P 500 index funds include the members of that benchmark, therefore track the index’s performance from year to year. As Buffett says, these funds bring together a broad variety of companies. And as we can see from the index’s and the particular fund’s composition — here I’ll use the SPDR fund — investing in these instruments offers you exposure to some of the world’s top companies.

Mirroring the S&P 500 Index, the SPDR S&P 500 ETF’s top five holdings are as follows:

| Company | Weight in index/fund |

|---|---|

| Microsoft | 7.08% |

| Apple | 6.78% |

| Amazon | 3.48% |

| Nvidia | 3.34% |

| Alphabet | 2.10% |

Favoring technology

This clearly favors technology, with tech making up more than 28% of the fund and the S&P 500 index. Since indexes are a reflection of what powers the economy at a given time, this isn’t a surprise — and it’s a key to growth for the index and funds that track it.

But it’s still fair to say the S&P fund offers broad exposure to companies of all sorts, with healthcare, financials, and consumer discretionary stocks weighing in the double digits. Finally, several other industries — including industrials and energy — make up the rest of the fund and index.

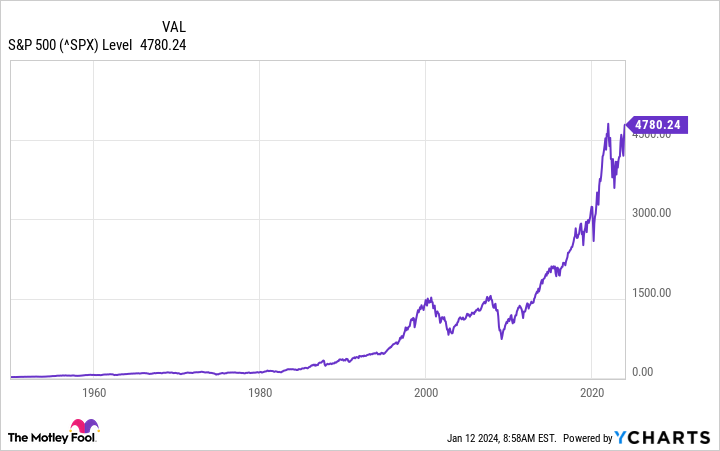

So, through buying an index fund, you’re investing in a broad range of stocks, and as history has shown us, you’re likely to win over the long term. The average rate of return annually for the stock market has been 10% over the past 50 years.

The magic of compounding

Now let’s put this to work. All of this means that if you invest $200 per month in the SPDR S&P 500 ETF over the next 15 years, your investment could reach $76,254. That’s thanks to compounding, or the idea that gains will create more gains as time goes by.

You will have contributed $36,000 over the period and generated more than $40,000 in returns. And the only thing you’ve had to do was make that monthly contribution. Of course, you can scale up or down this contribution according to your budget — and even a small amount invested could produce excellent returns over the long run.

Keep in mind this is just a model, assuming a 10% annual return over time. No one can predict what the stock market will do — and it has been known to surprise us. But it’s fair to be optimistic about long-term investing since the general market has consistently demonstrated it always beats bear markets and goes on to advance over time.

^SPX data by YCharts

And that’s why it’s a great idea to invest in a fund that tracks this performance.

Finally, one more important bit of advice from Warren Buffett: Make sure you invest in an index fund that’s inexpensive. With a P/E ratio of about 21, the SPDR S&P 500 ETF fits the bill.

So, whether you’re a confirmed stock picker or a new investor, a commitment to monthly index fund contributions could be an excellent way to start 2024 — and pave the way to wealth.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adria Cimino has positions in Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Microsoft, Nvidia, and Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

[ad_2]