Why Carvana Stock Lost 17% in September

[ad_1]

What happened

Shares of Carvana (CVNA -2.65%) were having another roller-coaster month in September. The online used car dealer’s stock briefly popped after its credit rating was upgraded, but soon after, the stock tumbled in response to the Federal Reserve’s interest rate forecast.

The strike by the United Auto Workers also seemed to weigh on the stock, and a weak report by rival CarMax may have given more fuel to the bears.

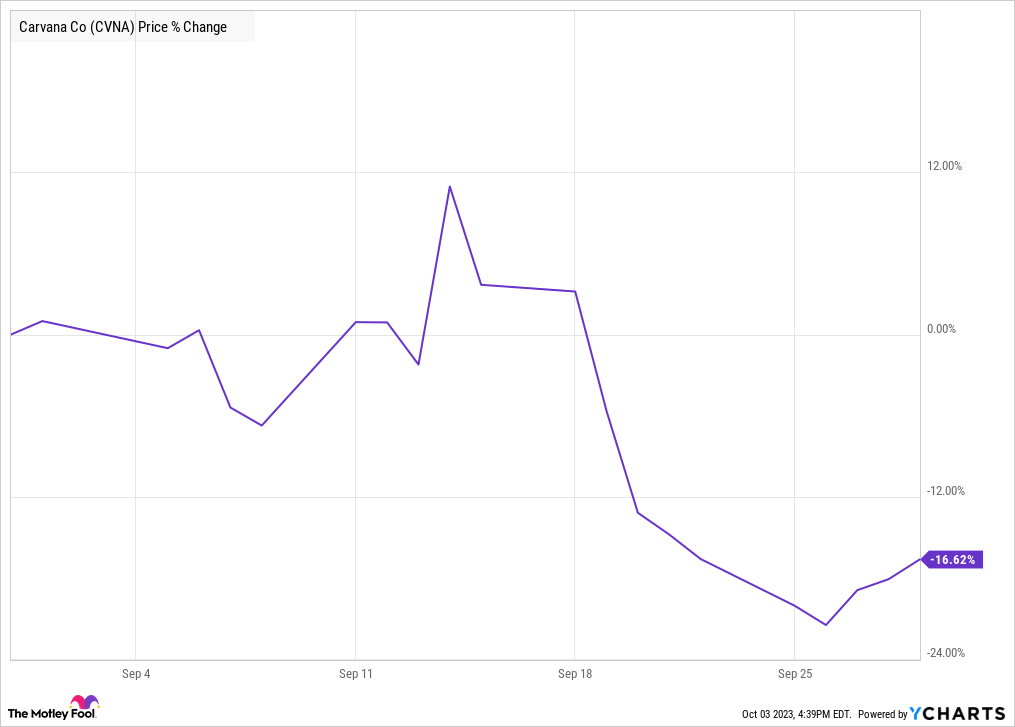

According to data from S&P Global Market Intelligence, the stock finished the month down 17%. As you can see from the chart, the stock was higher momentarily before declining in the second half of the month.

CVNA data by YCharts

So what

After trading mostly sideways to start the month, Carvana stock popped 8% on Sept. 11 after the S&P raised its credit rating from D to CCC+ with a negative outlook on the stock.

The ratings agency commented on Carvana’s completion of its debt restructuring, swapping senior unsecured notes for longer-dated senior secured notes. It said the company’s liquidity position has improved, but its “capital structure remains unsustainable.”

A few days later, Carvana jumped again 13.5% in response to a strong retail sales report and the perception the expected UAW strike would bump up used car prices.

However, Carvana quickly gave up those gains as the UAW strike went into effect, and even an analyst upgrade on the previously mentioned debt exchange was not enough to stem the sell-off.

Finally, the stock sank further after the Federal Reserve projected that interest rates would stay higher for longer in its interest rate decision on Sept. 20, with Carvana falling 8% that day.

As a used car dealer, the company has significant exposure to interest rates, which make car buying more expensive and therefore cools off demand. Though Carvana does capture some of the cash flow from financing its vehicles, rising rates are viewed as an overall negative for the industry due to the impact on demand.

At the end of the month, CarMax reported declining revenue in its second-quarter earnings report, which didn’t directly impact Carvana, but seemed to reflect the broader challenges in the industry.

Now what

Carvana’s stock is certainly on better footing than it was at the beginning of the year, but the company still has work to do to repair its business and drive profitable growth, and rising interest rates aren’t going to help.

Carvana’s future is ultimately in its own hands, but investor expectations have risen as the stock has soared this year.

Expect a big swing from the stock when it reports third-quarter earnings early next month, its next major update. Analysts see revenue falling 25% to $2.76 billion and its per-share loss narrowing to $0.82 a share.

[ad_2]