SoFi Stock Fell Today — Is This a Buying Opportunity for 2024?

[ad_1]

SoFi Technologies (SOFI -13.89%) stock plummeted in Wednesday’s trading. The fintech company’s share price closed out the daily session down 13.9%.

SoFi stock fell in today’s trading following news that Keefe, Bruyette & Woods (KBW) analyst Michael Perito had downgraded his rating on the stock from market perform to underperform. In addition to the ratings downgrade, Perito lowered his one-year price target on the stock from a previous rating of $7.50 per share to $6.50 per share.

Is SoFi stock’s big sell-off a buying opportunity?

The big sell-off for SoFi stock today after bearish coverage from KBW analyst Michael Perito highlights the fact that the company’s shares trade at a speculative, growth-dependent valuation. Analyst coverage tends to have an outsized impact on companies with uncertain futures.

While SoFi’s business has continued to grow sales at an encouraging double-digit rate, it remains difficult to predict where the business is heading over the long term. SoFi’s revenue climbed roughly 27% year over year to hit $531 million in the third quarter. The fintech company ended Q3 with total members of 6.9 million — up 47% year over year. SoFi’s sales and member base have continued to see solid rates of expansion, but questions about the company’s ability to deliver long-term earnings growth remain.

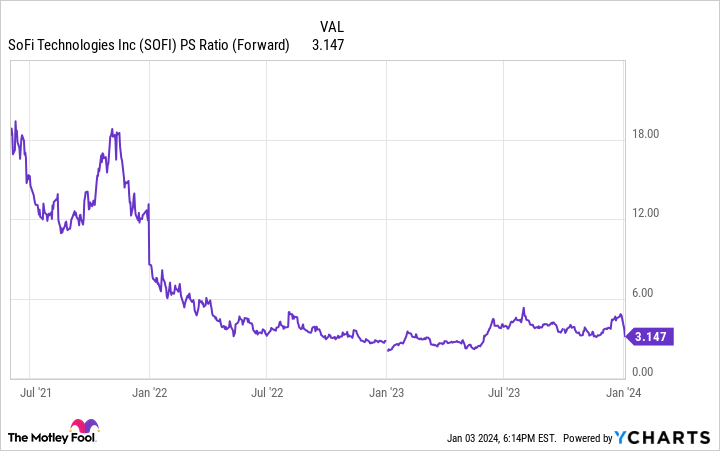

Even though SoFi stock is down roughly 68% from its lifetime high, its valuation picture is complicated.

SOFI PS Ratio (Forward) data by YCharts

Trading at roughly 3.15 times forward sales, SoFi looks attractively priced in the context of recent revenue growth. On the other hand, the company trades at approximately 98 times expected forward earnings, and the business’s performance trajectory remains highly speculative.

For risk-tolerant investors willing to embrace volatility in pursuit of potentially explosive returns, SoFi could be a smart portfolio addition on the heels of recent sell-offs. The stock probably won’t be a good fit for investors seeking stocks without big downside potential, but it could go on to see rebound trading that delivers strong returns.

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

[ad_2]