Unhappy With Your Stock Portfolio? 3 Easy Changes to Make in 2024

[ad_1]

A new year marks the perfect time to reflect on where you are financially and where you want to be. That includes your stock portfolio.

There are many reasons why you may feel unhappy with your portfolio. Maybe you’ve underperformed the market in recent years or aren’t on track to hit your financial goals. Or maybe you feel like you’re taking on risk and not getting the reward you expected.

Whatever the cause of the frustration, there are a few simple and easy changes you can make in 2024 to improve your sentiment. After all, we can’t control the whims of the stock market or wish a stock to go higher, but we can choose what to invest in and set checks and balances to prevent an emotional and financially painful decision. Here are three investing changes to consider in 2024.

Image source: Getty Images.

1. Align your investments with your risk tolerance

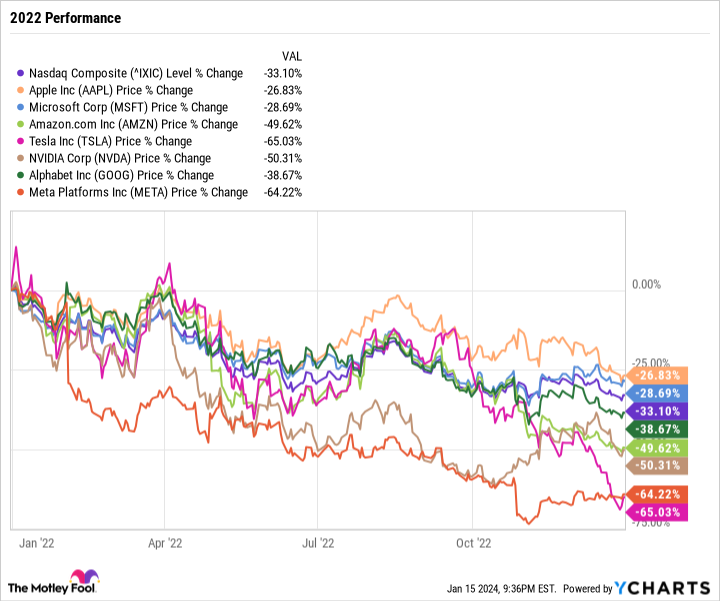

It’s easy to feel uneasy in the market if your risk tolerance and portfolio are misaligned. For example, you might look at the Nasdaq Composite‘s 43.4% return in 2023 or the outperformance by all the “Magnificent Seven” stocks and feel like you missed out. But zoom out just a little, and you’ll find that the Nasdaq lost 33.1% in 2022, and all of the Magnificent Seven stocks had terrible years.

^IXIC data by YCharts

Some of the greatest gains in the stock market follow painful losses. It takes a lot of patience and a long-term time horizon to hold through periods of volatility, and even more discipline not to sell the second a position begins to recover. In the stock market, just as with everything in life, knowing your tendencies is important. To quote the famous line from Shakespeare’s Hamlet: “To thine own self be true.”

If you’re more risk-averse, there are ways to achieve excellent returns over time by picking safe stocks, focusing on stable income-generating businesses, and having an ultra-diverse portfolio. You may not keep pace with a surging bull market, but you’ll also stand a better chance at avoiding the worst of a steep sell-off.

Or maybe you’re more risk-tolerant and feel your portfolio is too conservative. The worst thing to do in that instance is to chase high-flying expensive stocks just because you think they’ll go higher, without knowing anything about the companies in the first place.

The key takeaway is that nothing in the stock market is free. Investors who were highly concentrated in growth stocks suffered brutal losses in 2022. Those who were able to stomach the volatility were rewarded in 2023. But no one knows what will happen this year. The ride could continue, or a major correction could happen in big tech.

2. Practice high-conviction investing

This leads us to our next point: Only invest in companies you understand well. If you’re unhappy with your stock portfolio, chances are it’s because you’re wondering why other stocks are going up and the ones you are invested in aren’t, or stocks you own are going down and you’re losing money.

Again, anything can happen in the short term. Sometimes, stocks go down or up for the wrong reasons. But beyond that, it’s important to keep tabs on what’s happening in the broader market and the industries you’re investing in, and then drill down to the specific company.

Companies in the same industry tend to be quite correlated. If you own a lot of discretionary retail stocks and consumer spending is under pressure, those companies will share the same challenges. Similarly, if you’re investing in a growth industry like renewable energy, and interest rates are high, then there will be a higher cost of investment capital across the industry.

More important than the industry is the company itself. Just because you pick a stock in a hot industry doesn’t mean it will be a winner. There are factors to consider, like valuation, the company’s financial health, products and services, innovation, culture, leadership, growth plans, trajectory, and more.

It’s frustrating to look at a stock in your portfolio and wonder why you own it in the first place. To prevent that, only buy shares in companies you know well.

Before you buy a stock, it’s helpful to take some time to write down a few things (you can do the same exercise with an existing position):

- Explain why you invested in a company in the first place.

- Define what your investment thesis is for the stock.

- Outline what you expect from the company in the next year, three years, and five years.

- Answer what would have to happen for you to want to exit the position.

- List reasons why you may consider investing more in the company.

- Make note of any other useful ideas that can help make a future decision easier.

It sounds old-fashioned, but I find it helpful to jot these notes down in a journal and then review them when I’m looking for reassurance in my decisions. The idea is to limit the randomness of emotional decision-making so that I can act rationally when the market is irrational.

3. Challenges don’t always break the investment thesis

Having a clear idea of a company’s long-term investment thesis and measurable ways to ensure it remains on track to meet that investment thesis is vital to being a successful long-term investor.

This task is harder when dealing with a smaller, unproven company. If we go back and think about Netflix (NFLX -0.49%) in its early years as a public company, for example, the company struggled to stay profitable as management focused instead on subscriber growth and massive content spending. Before that, Netflix’s home delivery DVD plan competed directly with brick-and-mortar video stores. It took a long time for Netflix to build a powerful digital content library to transition purely to streaming. Even then, customers remained skeptical about the long-term viability of streaming and whether content creators would build their own services and take their shows and movies off Netflix.

The solution, as we know now, was for Netflix to produce its own content. There have been snags along the way and criticism for overspending on quantity rather than quality. But through it all, nothing changed about Netflix’s long-term investment thesis. It faced different challenges and had to evolve with the needs of customers. But it never gave investors a glaring reason to bail on the stock.

The Netflix investment thesis was, and continues to be, centered around easily accessible entertainment. The means of distributing that entertainment and the content itself have changed. But that’s expected and encouraged. Truly understanding the Netflix investment thesis would have made the stock easier to hold over the last 20 years. Maybe you sold a chunk here and there. But even a small position would have led to unbelievable gains.

Actionable changes that won’t derail your portfolio

In the stock market, it’s easy to spin the narrative of a good stock versus a bad stock, or a hot industry versus a cold one. But in reality, it’s much more important to look at a longer timeline, which smooths out randomness. An even bigger factor to consider is position sizing and portfolio allocation.

Returning to the Magnificent Seven stocks example, the headline news that mega-cap tech crushed the market in 2023 is true. But it’s impossible to assume that someone bought a stock at the end of 2022 at the perfect time and held it all of last year. For example, Tesla may have doubled in 2023. But it still lost 29.5% from 2022 through 2023.

Executing the practices in this article can help you feel better about your portfolio and grow closer to achieving your financial goals without the messiness that can come with a complete portfolio overhaul.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Netflix, Nvidia, and Tesla. The Motley Fool has a disclosure policy.

[ad_2]