Unilever Can’t Catch a Break With Wall Street, but You Might Want to Buy the Stock Anyway

[ad_1]

When Alan Jope took over as CEO of Unilever (UL -0.21%), the company was on the cusp of big changes. Jope did an admirable job, and also had to contend with the coronavirus pandemic along the way, but he has now stepped aside. New CEO Hein Schumacher has gotten to know the consumer staples titan and he’s presented investors with a business plan.

Wall Street analysts were unimpressed, but that doesn’t mean it’s a bad plan. Here’s why you might want to own Unilever despite what analysts think.

Unilever is a different company today

When Jope took the helm of consumer staples giant Unilever in early 2019, the company was set for a series of shifts. Notably, it was moving from an unusual dual-listing structure to being based entirely out of the United Kingdom. That was completed in late 2020. Also in the works over that span was the sale of slower-growing businesses like teas, a division sold in mid-2022. Along the way, the company was adding faster-growing brands via bolt-on acquisitions, such as the purchase of Liquid IV in a deal announced in late 2020.

Image source: Getty Images.

During that time period, Jope also had to deal with an activist investor in the form of Nelson Peltz. He was eventually added to the company’s board of directors. Unilever chose not to get into a big battle with the investor, who had previously had a very public fight with competitor Procter & Gamble. And, of course, the larger global backdrop through much of Jope’s tenure includes the coronavirus pandemic and the impact it has had on consumer demand, supply chains, and inflation.

Simply put, Jope had to carry a heavy load. It wasn’t a perfect run, but he saw the company through a transition period and it is now positioned very differently than it was in 2019. This is where Schumacher comes in. He has inherited a business that is more streamlined and shifting in the direction of growth.

Unilever underwhelms Wall Street

Schumacher just held his second earnings conference call. On the first call, he basically introduced himself, explained he was excited to be the CEO and that he’d take some time to figure out what he wanted to do as the new boss. It was a completely reasonable approach and investors were happy to wait for details. That Q3 update came with a long strategic presentation.

Generally speaking, the questions from Wall Street analysts made it very clear that Schumacher’s plan wasn’t enough to impress them. The big takeaway seemed to be that very little about Unilever’s long-term road map was going to change. It boils down to cutting costs, focusing more on the biggest and best brands, pushing product innovation, and streaming line management (including tying pay more closely to performance). As one analyst noted, however, these things sound like business basics.

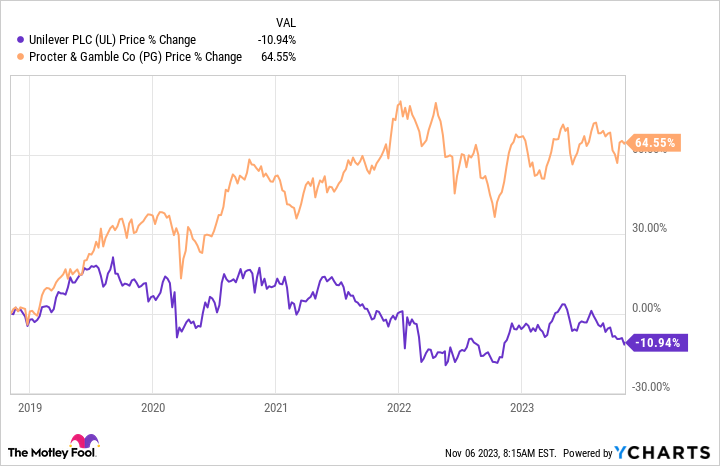

UL data by YCharts

Indeed, a rapid upturn in performance seems unlikely. But from a long-term investor’s point of view, getting the basics right should probably be a good thing after a period of business upheaval that has significantly altered the company’s operations. Furthermore, Unilever’s blueprint is very similar to the one that Nelson Peltz pushed at Procter & Gamble. That plan proved to be quite beneficial for the company, which has been performing better than peers for several years.

Unilever is a different company (it has more emerging market exposure and sells both food and consumer products), but there’s no reason to think that the steps which helped Procter & Gamble turn its business around would be a mistake here. In fact, after the changes that have already recently taken place, you could argue that slow and steady is the more advisable choice.

No reason to avoid Unilever

Unilever is a giant in the consumer staples space, with a global portfolio of well-known and much-loved brands. The dividend yield is an attractive 3.9%, which is toward the higher side of the company’s historical yield range. While Unilever hasn’t performed as well as some peers like P&G, a lot of change has occurred in a short period of time.

With the new CEO largely sticking with the long-term plan, which Peltz most likely influenced, investors shouldn’t expect a quick change in performance. But you can still collect that historically high yield from an industry leader while you wait for the slow-and-steady approach being taken to play out. For income investors who think in decades, that’s probably a good outcome.

[ad_2]