Why Norwegian Cruise Line Stock Dropped 11% Last Month

[ad_1]

Shares of cruise ship company Norwegian Cruise Line Holdings (NCLH -3.38%) dropped 11.2% in January, according to data provided by S&P Global Market Intelligence. Cruise stocks weren’t exactly popular during the month, and Norwegian is viewed by some as one of the riskier publicly traded cruise companies.

For example, Wells Fargo analyst Daniel Politzer downgraded his outlook for Norwegian stock on Jan. 5 while simultaneously upgrading his outlook for competitor Carnival. According to Investing.com, Politzer was looking at Norwegian’s more modest upside opportunity and its relatively high debt load. Moreover, the company’s execution hasn’t been perfect.

To this latter point, in its third-quarter earnings call on Nov. 1, Norwegian’s management said that geopolitical conflicts were leading to higher cancellations and lower bookings for the upcoming fourth quarter. Consequently, the company expects to report an adjusted loss per share of $0.15 for the quarter.

For perspective, its top rivals Carnival and Royal Caribbean don’t expect adjusted losses, so it calls Norwegian’s execution into question for some investors.

Against this backdrop, it’s understandable why some investors may find Norwegian stock the least attractive of the three big publicly traded cruise stocks.

What’s Norwegian doing right now?

The good news for Norwegian shareholders is that the company is increasing its capacity. By bringing more ships online, the company could sail with 22.7 million cruisers in 2023, which was an 18% year-over-year increase. Moreover, the company has kept ships mostly full, even if the upcoming Q4 has elevated cancellations.

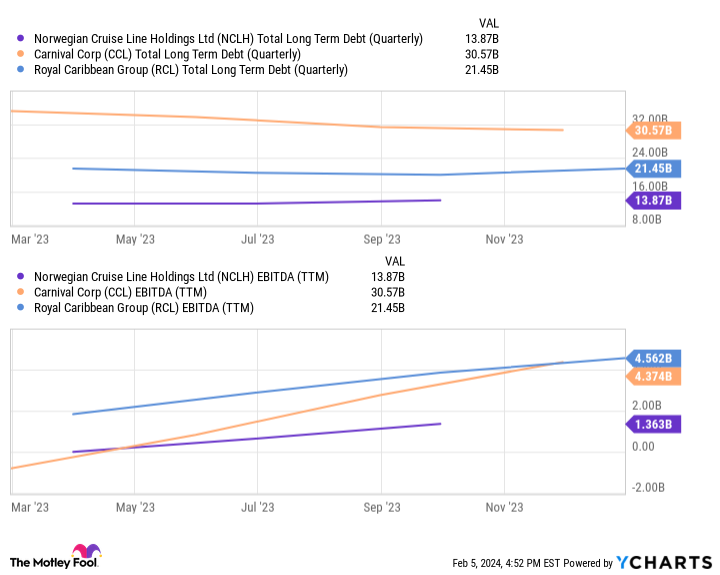

Politzer mentioned Norwegian’s elevated debt levels. Indeed, the chart below does show high debt compared with its earnings before interest, taxes, depreciation, and amortization (EBITDA), especially relative to its peers.

NCLH Total Long Term Debt (Quarterly) data by YCharts

But give Norwegian some credit. Through the first three quarters of 2023, the company reduced its debt by $1.5 billion. That’s about a 10% reduction in debt in just nine months, which is nothing to sneeze at.

What should investors do now?

Still, Norwegian may have modest upside right now compared to other cruise stocks. It only expects to increase its capacity by 4% in 2024 — for comparison, Carnival expects a 5.4% increase in 2024 capacity.

Over the long term, Norwegian expects more increases in capacity. And some analysts believe that the company’s growth could contribute to its EPS tripling through 2027. That could indeed point to some long-term upside for the stock if things go right.

However, it may be prudent to wait and see if Norwegian can perform with a little more consistency before investors give it the full benefit of the doubt. If growth in 2024 is as modest as expected, there might still be plenty of time before the stock takes off, which would allow investors more time to better evaluate its performance.

Wells Fargo is an advertising partner of The Ascent, a Motley Fool company. Jon Quast has no position in any of the stocks mentioned. The Motley Fool recommends Carnival Corp. The Motley Fool has a disclosure policy.

[ad_2]