Why Spirit AeroSystems Stock Is Flying High Today

[ad_1]

Spirit AeroSystems (SPR 24.26%) has secured a lifeline from Boeing, its most important customer, which will help the aerospace manufacturer smooth out production issues. Investors are relieved, sending shares of Spirit up more than 20%.

Spirit buys time

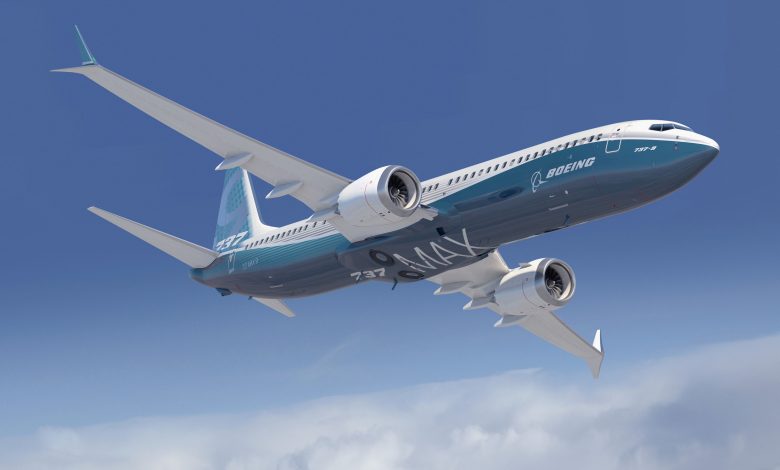

Spirit is a one-time subsidiary of Boeing that is still responsible for the manufacture of key components of Boeing’s most important jets. But Spirit has had its share of difficulties of late, including an August disclosure that Spirit quality issues would delay the delivery of Boeing 737 MAX aircraft.

On Wednesday, the two companies announced a memorandum of understanding that they say will lead to “greater collaboration” to improve product quality and increase deliveries. The deal also includes some near-term price improvements on airframes manufactured by Spirit and purchased by Boeing. The aerospace giant has also agreed to provide Spirit with a series of cash advances, including an immediate $100 million.

“Boeing and Spirit will continue to work shoulder to shoulder to mitigate today’s operational challenges,” Spirit AeroSystems said in a statement.

Is Spirit a buy after its Boeing deal?

Even with Wednesday’s stock surge, shares of Spirit AeroSystems are still down 28% year to date. There is an opportunity here, but investors need to understand that the risk is still substantial.

Spirit has effectively reworked payment schedules and secured cash advances to give it time to get its manufacturing house in order. The deal reflects the fact that right now Boeing needs Spirit as badly as Spirit needs Boeing, but that leverage can only help so much. Boeing is trying to keep its costs as low as possible to compete with Airbus on global airline sales and can’t afford to give too much.

Spirit in announcing the deal also disclosed additional forward losses in a series of aircraft programs, a sign that the business still needs some repairs.

The deal removes some of the immediate concern about Spirit, but this remains a company squeezed between the rising costs of its own labor and materials and a customer that is doing its best to keep its own costs down. It has been a difficult position for Spirit throughout the nearly 20 years since it was split out of Boeing, and that seems unlikely to change in the foreseeable future.

Lou Whiteman has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

[ad_2]