2 Top Artificial Intelligence (AI) Stocks Ready for a Bull Run

[ad_1]

Artificial intelligence (AI) has been the driving force behind the surge in technology stocks in 2023, leading to a 57% jump in the Nasdaq-100 Technology Sector index this year as several companies are benefiting — or stand to benefit — from the growing adoption of this technology.

Taiwan Semiconductor Manufacturing (TSM 0.51%) and Snowflake (SNOW 1.58%) are two companies that are witnessing the positive impact of growing AI adoption on their businesses. Shares of both companies are up 34% so far this year, but it won’t be surprising to see them step on the gas in 2024 and deliver much stronger gains as AI starts having a stronger influence on their businesses.

Let’s look at the reasons why these two tech stocks seem set for a bull run.

1. Taiwan Semiconductor Manufacturing

Foundry giant Taiwan Semiconductor Manufacturing, popularly known as TSMC, is playing a central role in the growing adoption of AI. That’s because the world’s leading AI chipmaker, Nvidia, sources its AI chips from TSMC.

Nvidia is a fabless semiconductor company, which means that it only designs and sells the chips — manufacturing is outsourced to foundries such as TSMC. It is worth noting that the booming demand for Nvidia’s AI chips is positively impacting TSMC’s business as well, as the former is placing more orders to meet the booming end-market demand. This explains why the Taiwan-based company saw a big surge in monthly revenue in October, snapping a seven-month streak of sales declines.

TSMC witnessed a drop in sales and earnings in 2023 on account of weakness in key markets such as smartphones and personal computers. AI chips, however, have been a bright spot for the company. This is evident from the growth in the sales of chips manufactured by TSMC on its 5-nanometer (nm) manufacturing node.

TSMC got 37% of its third-quarter 2023 revenue of $17.3 billion from selling 5nm chips, which equates to $6.4 billion. That was an increase of 14% from the year-ago period when 5nm chips accounted for 28% of its total revenue of $20.2 billion. For comparison, TSMC’s Q3 revenue was down almost 15% year over, indicating that AI is already a catalyst for its business.

This catalyst is set to become bigger for TSMC in 2024 for a couple of reasons. First, the company is working to substantially increase its advanced chip packaging capacity. On its October earnings conference call, CEO C.C. Wei remarked that the company will more than double the capacity of its advanced packaging technology, known as CoWoS (chip-on-wafer-on-substrate), to meet the surging customer demand.

The company plans to increase CoWoS packaging capacity in 2025 as well. That’s not surprising as this technology allows chipmakers to place multiple chiplets and memory in a single package, allowing chipmakers to extract more power and efficiency that are critical for training AI models. So, the increase in CoWoS packaging capacity should allow TSMC to fulfill more orders from the likes of Nvidia next year.

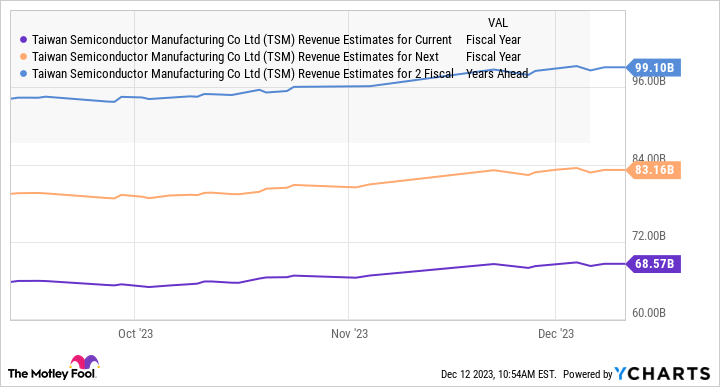

What’s more, Nvidia is expected to adopt TSMC’s 3nm architecture in 2024 for making its next-generation graphics cards. All this explains why analysts are anticipating TSMC’s fortunes to turn around in 2024. The company’s revenue is anticipated to drop 9% in 2023 to $69 billion, but it is expected to deliver almost 20% revenue growth for the next couple of years.

TSM Revenue Estimates for Current Fiscal Year data by YCharts

If TSMC does hit $99 billion in revenue in 2025 and it can maintain its five-year average sales multiple of 8.5 at that time, its market cap could jump to $841 billion in a couple of years. That would be a 60% jump from current levels. With TSMC stock trading at 7.6 times sales right now, investors can buy it at a relatively cheaper valuation, and they may not want to miss this opportunity given the potential upside it could deliver.

2. Snowflake

Snowflake operates a cloud-based data platform that is used by its customers to consolidate data, and then use that data to build applications and gain business insights, among other things. Snowflake, therefore, is going to be another key in the proliferation of AI as large language models (LLMs) are trained using huge amounts of data to develop popular applications such as ChatGPT.

Not surprisingly, Snowflake CEO Frank Slootman remarked on the company’s November earnings conference call:

Generative AI is at the forefront of customer conversations, which in turn drives renewed emphasis on data strategy in preparation of these new technologies. We said it many times: There’s no AI strategy without a data strategy. The intelligence we’re all aiming for resides in the data, hence the quality of that underpinning is critical.

In simpler words, the quality of data by which AI models are trained will dictate the accuracy of the results that they deliver.

Snowflake is looking to capitalize on the need for quality data by encouraging more of its large and growing customer base to share data through its data-sharing architecture. The company says that 28% of its 8,900-strong customer base is sharing data, up from 22% in the year-ago quarter, when it reported a customer base of 7,200.

The company is also offering other AI-related services, such as a fully managed service — known as Cortex — to help companies analyze proprietary data and build AI apps. Snowflake customers can summarize documents, extract information, and translate text, among other things, using the Cortex platform without having to invest in expensive hardware.

More importantly, Snowflake is looking to push the envelope by developing new AI-related services. One of these is Document AI, which will enable organizations to turn unstructured documents into semi-structured documents and use them for further analysis.

In all, the growing importance of quality data thanks to the adoption of generative AI is going to be a tailwind for Snowflake and help accelerate the impressive growth the company is already delivering.

The company recently raised its full-year product revenue outlook thanks to an improvement in customer spending. Snowflake is expected to exit fiscal 2024 (which will end in January 2024) with a 35% spike in revenue to $2.79 billion, followed by healthy growth in the next couple of years as well.

SNOW Revenue Estimates for Current Fiscal Year data by YCharts

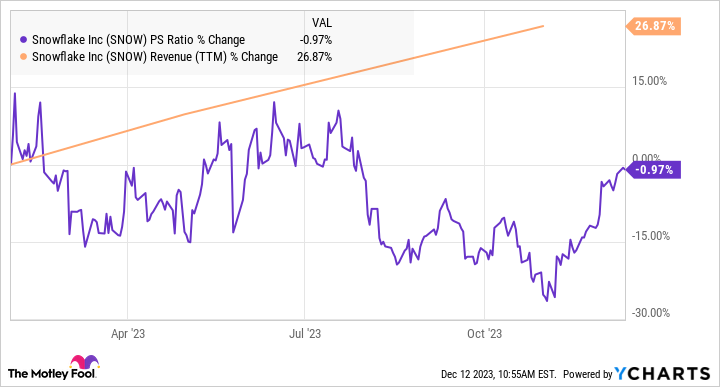

Investors, however, may be wondering if Snowflake stock is worth buying at a rich 24 times sales. The good news is that Snowflake’s top line has headed substantially higher in the past year and its sales multiple has remained the same.

SNOW PS Ratio data by YCharts

With a potential acceleration in growth thanks to new catalysts such as AI, investors would do well to buy the stock right now as it has gained robust momentum following Snowflake’s latest results and could go on a sustained bull run.

[ad_2]