4 Social Security Mistakes That Could Cost Retirees Thousands of Dollars

[ad_1]

Social Security is an important source of financial well-being among older Americans. Nearly 90% of retired workers say they depend on benefits to some degree, and roughly 40% get at least half of their income from the program. Those statistics make it imperative that current workers understand Social Security.

Unfortunately, research consistently uncovers problematic knowledge gaps across the adult population. Read on to see four Social Security mistakes that could cost retirees thousands of dollars.

Image source: Getty Images.

1. Misunderstanding the rules regarding early retirement

Many Americans misunderstand the rules regarding early retirement. A survey from Nationwide Retirement Institute found that 49% of adults mistakenly believe their benefit will automatically increase at full retirement age (FRA) if they claim Social Security early. That’s incorrect.

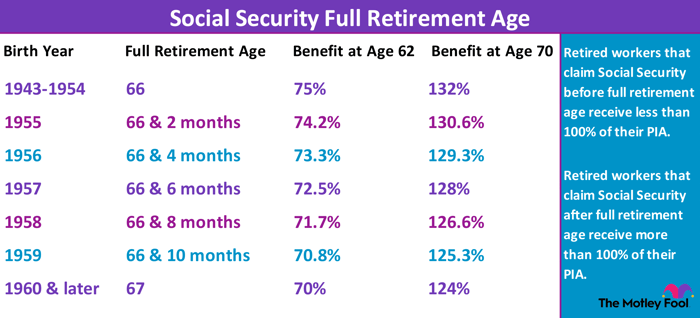

Workers can start Social Security at age 62, but they will not get their full retirement benefit (also known as the primary insurance amount or PIA) unless they claim Social Security at FRA. Workers who claim before FRA receive a permanently reduced benefit, meaning they get less than 100% of their PIA. And workers who delay Social Security beyond FRA receive a permanently increased benefit, meaning they get more than 100% of their PIA.

The chart below shows the relationship between FRA and birth year, and it details the Social Security benefit (as a percentage of PIA) that retired workers would receive at ages 62 and 70.

Chart by Author.

2. Claiming Social Security before the optimal age

Research has shown that most retirees would maximize lifetime income by delaying Social Security until age 70. But less than 10% of newly awarded retired workers started benefits at age 70 last year, and 24% actually filed for Social Security as soon as possible, locking in the smallest possible payment for life.

While some people simply cannot afford to wait until age 70 to start collecting Social Security, a significant portion of retirees also choose not to wait because they don’t understand how it maximizes their lifetime benefit.

A recent study conducted by economists from the Federal Reserve Bank of Atlanta and Boston University examined the repercussions of those decisions. Among workers aged 45 to 62, failure to optimize Social Security will cost the median household $182,000 in lifetime spending power, assuming current behavioral patterns persist in the future.

3. Not being familiar with Social Security spousal benefits

A recent survey from MassMutual found that over one-quarter of workers nearing retirement were unaware that spouses can claim Social Security benefits on the work record of their retired partner. The spousal benefit can be worth up to one-half of the retired worker’s PIA, but there are three important considerations.

First, the retired worker must already be receiving Social Security in order for the spouse to qualify. Second, the spouse will receive a smaller payout if they claim before FRA, meaning their benefit will be less than half of the retired-worker’s PIA. Third, the spouse cannot earn delayed retirement credits, so their benefit will not increase if they claim Social Security after FRA.

4. Not knowing how much income to expect from Social Security

The previously mentioned Nationwide Retirement survey also found that 42% of adults were unsure about how much income Social Security would provide in the future. In general, retirement benefits replace about 40% of pre-retirement income, but the precise answer depends on work history, lifetime earnings, and claiming age.

Fortunately, the Social Security Administration makes that information available online. Anyone can create a my Social Security account to estimate their future benefit.

Here’s the bottom line: Most workers cannot effectively plan for retirement unless they have some idea of their future Social Security benefit. Without that information, workers may save less or retire earlier than they otherwise would have, and both decisions could lead to lost income and a lower living standard in retirement.

[ad_2]