3 Dow Jones Dividend Stocks That Are Within 6% of Their 52-Week Lows to Buy Now

[ad_1]

Some well-known stocks have been noticeably absent from the market rally.

Even with recent market turbulence, it has been an overall good year in the stock market. But the Dow Jones Industrial Average is only up 2.4% year to date (YTD) — lagging behind the Nasdaq Composite‘s nearly 7% YTD return and the S&P 500‘s nearly 8% gain.

The Dow Jones contains many industry-leading blue chip companies. However, there are plenty of Dow stocks that are down this year, and some particularly big names that are within 6% of their 52-week lows — including Apple (AAPL 0.86%), Nike (NKE), and UnitedHealth (UNH -0.57%). Here’s why all three dividend stocks are down, but why they could be worth buying now.

Image source: Getty Images.

From sector leader to sector underperformer

Apple is arguably the most surprising stock on this list. It makes up over 7% of the Nasdaq Composite. And despite Apple weighing down the index, the Nasdaq Composite hit an all-time high on March 21 and is still up big on the year. Investors have been used to Apple leading the market, not lagging behind it.

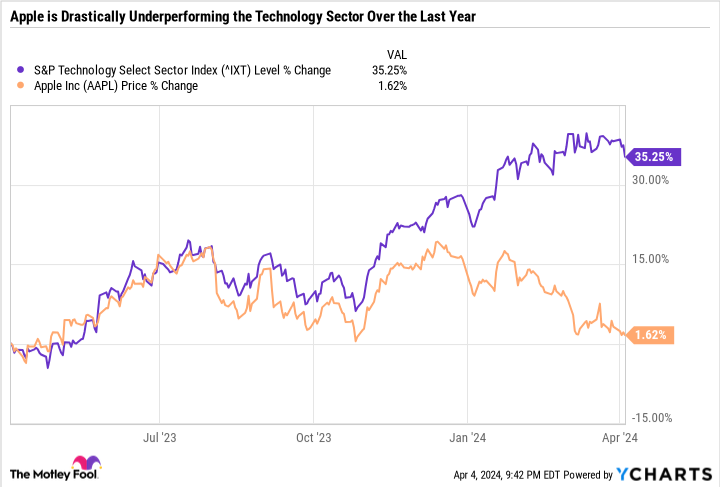

The underperformance is even more drastic when looking at the technology sector. Apple makes up 19.2% of the Technology Select Sector SPDR Fund, an exchange-traded fund that mirrors the performance of the tech sector. Yet, the stock is about flat over the last year, while the sector is up over 35%.

^IXT data by YCharts

It would be one thing if Apple were simply part of a broader Nasdaq and tech sector sell-off. But any time you see an industry leader move in the opposite direction of its peer group, that’s usually a sign that investors have specific concerns about a company.

For Apple, the concerns are mostly justified. The growth just isn’t there. Sales in Apple’s second most important market — China — are declining. Apple’s lack of artificial intelligence (AI) monetization, and frankly innovation in general, is a bad look compared to other big tech stocks like Microsoft and Nvidia that are leveraging AI as a coiled spring for multi-decade growth.

Apple looks out of step, so it’s hard to fault investors for hitting the sell button. To make matters worse, the Department of Justice filed a civil antitrust lawsuit against Apple for monetizing smartphone markets.

The silver lining is that Apple has a mere 26.1 price-to-earnings (P/E) ratio — making it far cheaper than the tech sector’s 38.7 P/E ratio. Apple generates plenty of cash, allowing it to repurchase stock and raise the dividend even during slowing growth.

One look at Apple’s meager 0.6% dividend yield may lead you to believe the company has a weak capital return program. In fact, it simply chooses to distribute the vast majority of funds through buybacks rather than the dividend. Apple’s buybacks have been an excellent investment, considering the stock’s performance. Buybacks can be particularly effective when a stock is beaten-down, and the company can swoop in and repurchase shares on the cheap.

Counting Apple out has been a losing bet in the past. The company’s brand and vertical integration are still strong, so value investors may want to step in and consider the stock now.

It’s time to move past Nike’s temporary earnings spike

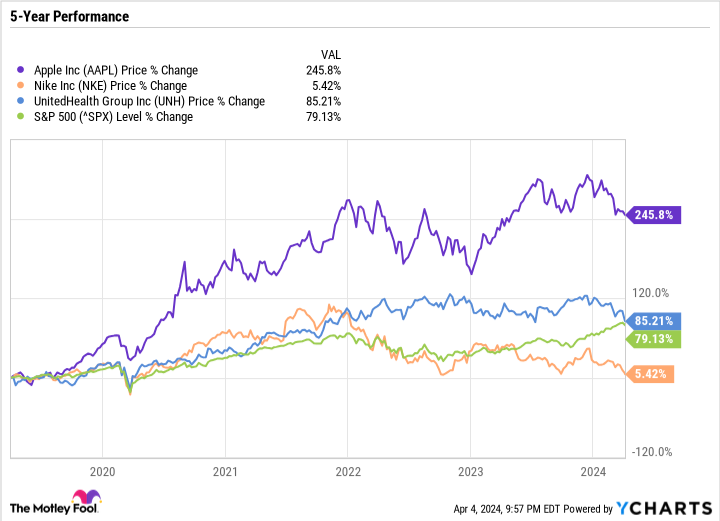

Despite its underperformance, Apple has still produced market-beating gains over the last five years. The same can’t be said about Nike. Despite putting up monster gains in 2020 and 2021, Nike stock has round-tripped and is now about where it was five years ago.

AAPL data by YCharts

Nike is a good example of why it is bad to anchor a stock to a price it probably should have never reached in the first place. During the height of the pandemic, people had limited options to spend on services, so they flocked to goods spending. Nike benefited greatly from that. However, the growth proved to be short-lived.

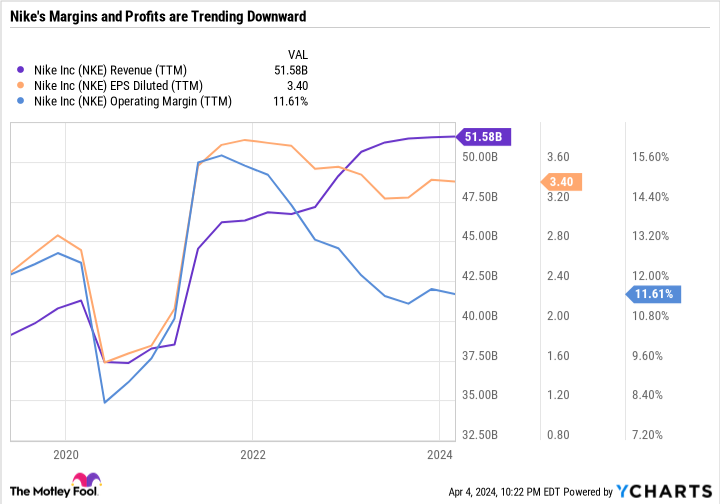

NKE Revenue (TTM) data by YCharts

As you can see in the chart, Nike’s earnings per share and operating margin initially plummeted at the onset of the COVID-19 pandemic, but then shot up in 2021 — corresponding with the stock’s record high. Sales have ticked up, but at the expense of lower earnings and margins. The business is closer to where it was pre-pandemic than where it was in 2021, so it’s understandable why the stock price has retraced.

To its credit, Nike has prioritized its capital return program amid slowing growth. It is buying back stock and its dividend is up 68% in just five years.Granted, the stock yields just 1.6%, but Nike is turning into a worthy dividend candidate, rather than relying purely on growth as it did in the past.

Like Apple, Nike is one of the most influential brands in the world. Nike now has just a 26.2 price-to-earnings ratio — below the S&P 500’s 27.9 P/E. The short-term outlook isn’t great, but patient investors are getting the chance to buy Nike at a compelling price.

Dip your toes into the healthcare sector with UnitedHeatlh

Like Apple, health insurance provider UnitedHealth still outperformed the market over the last five years. But the stock has sold off recently, mainly due to a lower-than-expected payment rate increase for the 2025 calendar year.

UnitedHealth’s growth is heavily dependent on its Medicare business, so the sell-off makes sense. To make matters worse, UnitedHealth was also the victim of a cyberattack, which caused the company to fall behind on claims payments.

Short-term challenges aside, it would be a mistake to underestimate UnitedHealth’s role in the healthcare sector. Drugmakers push the boundaries of innovation, but insurance is the glue that holds the U.S. healthcare system together. The sector has ballooned to become the country’s third-largest sector, behind only financials and tech.

UnitedHealth is a good choice for investors who want to invest in the healthcare sector, but not through a high-flying drugmaker like Eli Lilly. UnitedHealth lies on the stodgier end of the healthcare sector and is more focused on moderate growth and raising its dividend — which is up 400% over the last decade. It has a 19.1 P/E ratio, making it a good value for those looking for less expensive stocks to buy now.

Daniel Foelber has the following options: long July 2024 $95 calls on Nike. The Motley Fool has positions in and recommends Apple, Microsoft, Nike, and Nvidia. The Motley Fool recommends UnitedHealth Group and recommends the following options: long January 2025 $47.50 calls on Nike, long January 2026 $395 calls on Microsoft, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

[ad_2]