Super Micro Computer Is Up a Jaw-Dropping 160% This Year. Is It Time to Take Gains?

[ad_1]

On the short-list for best-performing stocks in 2024 is undoubtedly Super Micro Computer (SMCI 4.42%). Known as Supermicro, this maker of high-performance computer servers has seen its shares rise 160% in just the opening weeks of 2024. While Nvidia has been heralded as one of the top artificial-intelligence stocks, Supermicro is outperforming it — a fact that has caused many investors to take notice.

But with Supermicro already up so much in 2024, is it still worth considering? Or has the computer wunderkind simply run up too far, too fast? Let’s find out.

Super Micro Computer plays a vital role in AI

Supermicro benefits from the trend that pushed Nvidia higher: artificial intelligence (AI). Super Micro Computer makes highly customizable servers tailored for engineering simulations, drug discovery, or AI model training.

These servers are filled with hundreds or thousands of GPUs (graphic processing units), often made by Nvidia. Supermicro works closely with Nvidia to ensure they’re squeezing as much performance out of them as possible. GPUs are critical in this application, as they are well-suited to handle arduous computing tasks.

With many management teams across the globe asking their employees how their business will harness the power of AI, it all starts with getting enough computing power to make these models. Two ways to achieve this are buying an on-site server or renting cloud computing space. Supermicro benefits when companies buy their servers, and with its latest earnings, it’s evident this has been a popular pick.

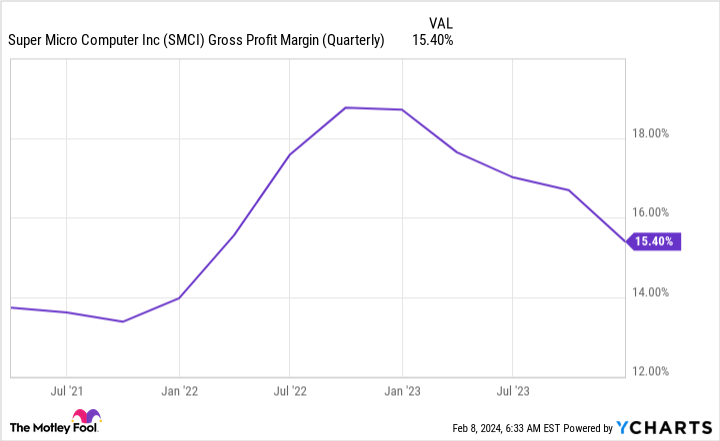

For its fiscal 2024’s second quarter (ended Dec. 31), management guided for about $2.8 billion in revenue. However, they far exceeded that and delivered $3.67 billion. This growth did come at a price, as Supermicro’s gross margin tumbled in the quarter.

SMCI Gross Profit Margin (Quarterly) data by YCharts

This occurred because management is focusing on capturing a massive and expanding market. But because its revenue growth was so large (up 103% year over year), its profit growth was also impressive, with earnings per share (EPS) increasing from $2.33 to $5.59. The good times are expected to continue as management gave a third-quarter outlook of $3.9 billion, indicating 205% growth.

Is Supermicro too expensive?

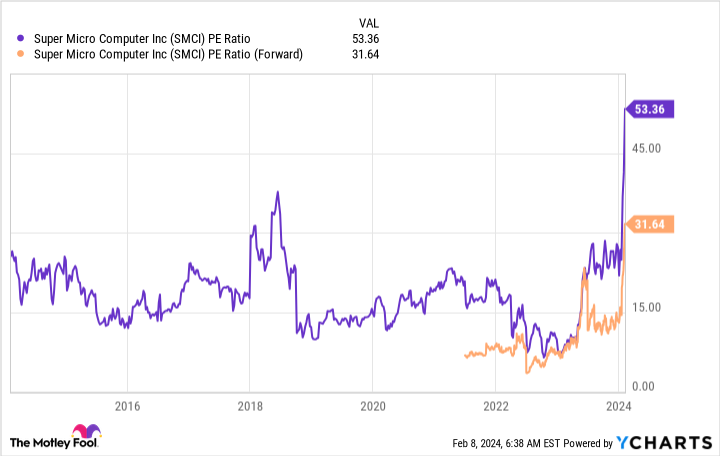

No one denies that Supermicro is having its moment in the spotlight with its strong Q2 and impressive full-year guidance, but many might wonder if it’s time to take gains or at least reduce exposure. With its latest run-up, Supermicro’s stock has gotten quite expensive.

SMCI PE Ratio data by YCharts

At these levels, many may worry that Supermicro is becoming too expensive. However, it’s all relative. If this strong demand persists for only a year and falls off a cliff, it’s too expensive. But if this trend lasts for three years, the stock still has a lot of upside ahead.

For fiscal 2024 (ending June 30), management expects about $14.5 billion in revenue. However, the company’s goal is to reach $25 billion in annual sales. In the first quarter of fiscal 2024, this goal was $20 billion in sales per year, so it’s clear that Supermicro’s management sees this demand increasing and sticking around.

Even though the stock may seem expensive now, it’s probably worth holding on to right now. But if this impressive run-up now means that the stock comprises a significant amount of your portfolio, then there’s no shame in selling a portion to redeploy elsewhere.

The AI arms race is starting to benefit more companies than just Nvidia, and anyone who’s in on the trend will be able to profit from this rise.

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool recommends Super Micro Computer. The Motley Fool has a disclosure policy.

[ad_2]